Signing up for Digital Federal Credit Union (DCU) is easy and fast. It lets you access great financial services. By joining DCU, you get personalized banking that’s safe and convenient. This guide will show you how to join, what benefits you get, and what you need to do.

DCU offers banking that’s easy to use and affordable. It helps you manage your money better. Let’s see how DCU can help you with your financial needs.

Key Takeaways

- Easy online account registration for new members.

- Access to a variety of free or low-cost financial services.

- Enhanced security features protect your financial information.

- Membership eligibility includes familial connections and employment opportunities.

- Initial deposits and required documentation facilitate smooth sign-up.

- Promotional offers available for new members, including free checking options.

Understanding the Benefits of Joining Digital Federal Credit Union

Joining Digital Federal Credit Union brings many benefits. You get affordable financial services and a user-friendly online banking system. These perks help you manage your money better and grow your finances.

Access to Free or Low-Cost Financial Services

Members enjoy free or low-cost services. You can cash checks, pay bills online, and get great rates on loans and savings. There are no hidden fees, so you can use your money wisely.

Convenience of an Online Banking Experience

Online banking is super convenient. You can manage your accounts and make transactions anytime, anywhere. This 24/7 access lets you control your finances easily.

Enhanced Security for Your Funds

Security is a big deal at Digital Federal Credit Union. Your accounts are insured up to $250,000 by the National Credit Union Administration (NCUA). You can trust that your money is safe from theft and damage.

Opportunities for Building Credit History

Joining Digital Federal Credit Union helps you build a good credit history. Using loans and credit cards can improve your credit score. This makes it easier to get loans in the future.

| Benefit | Description |

|---|---|

| Financial Services | Access to numerous free or low-cost services enabling efficient management of finances. |

| Online Banking | Manage accounts anytime and anywhere via mobile and web platforms, enriching convenience. |

| Security | Federal insurance covering up to $250,000 provides peace of mind regarding fund safety. |

| Credit Building | Opportunities to build and improve credit history through various financial products. |

Eligibility Requirements for Membership

To join DFCU, you need to meet certain criteria. Knowing these requirements makes the application process easier. These criteria often depend on your job, where you live, or your family ties.

Personal Qualifications for Joining

Here are the key qualifications for joining DFCU:

- Working for or having retired from a company listed among DCU’s participating employers.

- Having a family relationship with current DCU members, which can include spouses, partners, children, and extended family members such as grandparents and siblings.

- Living, working, worshipping, or schooling in designated communities as outlined by DCU.

These criteria show that DFCU welcomes many people from different backgrounds.

Understanding Membership through Employment or Location

You can join DFCU through your job or where you live. If you work at one of the over 200 companies linked to DFCU, you qualify. Also, if you’re related to a current member or live in certain areas, you can join too. Here are some main membership types:

| Membership Type | Description |

|---|---|

| Employment | Current or retired employees of participating organizations. |

| Family Membership | Relatives of current DCU members. |

| Community Member | Residents of specific communities served by DCU. |

| Organization Affiliation | Members of organizations that partner with DCU. |

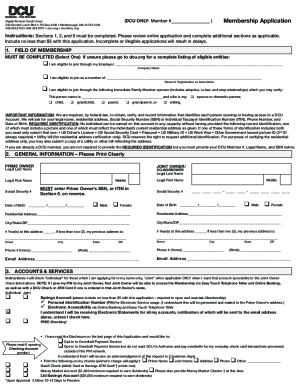

Gathering Necessary Documents for Digital Federal Credit Union’s Registration

Before joining the Digital Federal Credit Union (DCU), you need to gather some important documents. These documents help make the application process smooth and ensure you follow the credit union’s rules.

Identification Requirements

First, you must prepare valid identification for opening an account. You’ll need a government-issued ID like a driver’s license or passport. Also, you’ll need to provide your Social Security Number to confirm your identity and meet compliance standards.

Proof of Address Documentation

Next, you’ll need to provide proof of your address. You can use a recent utility bill, bank statement, or rental lease agreement. These documents prove where you live and are important for the credit union’s records.

Initial Deposit Considerations

The amount needed for the initial deposit varies. At DCU, you only need $5 to open an account. Other places might ask for more, up to $100. Having this money ready can make opening your account easier.

| Document Type | Description | Purpose |

|---|---|---|

| Identification | Government-issued ID (e.g., driver’s license, passport) | Verify identity for compliance |

| Social Security Number | Necessary for identification | Supports identity verification |

| Proof of Address | Recent utility bill or rental agreement | Establish residency |

| Initial Deposit | $5 required by DCU | Start the account |

Step-by-Step Process for Online Account Registration

Starting your journey to create a DFCU account is easy. It begins with online account registration. This guide will walk you through each step. It ensures you know what to do during your membership application.

Creating Your Digital FCU Enrollment Account

First, go to the Digital Federal Credit Union website. Click “Join” to start. You’ll need to create an enrollment account. This requires your legal name, address, Social Security Number or ITIN, phone number, and birthdate.

Have two IDs ready. One should have a photo and the other your current address.

Completing the Application Form

After setting up your account, fill out the membership application. It asks for family ties or work with certain groups. Make sure to include your first deposit, which must be at least $5.00.

It usually takes 3-5 business days to process. Quick and accurate answers can speed up your application.

What Happens After Submission

After you apply, wait a short time for processing. DFCU will contact you within 3-5 business days. If approved, you’ll get a welcome kit and your debit or ATM card in 7-10 days.

For your first login, use your member number and the last four digits of your SSN. Change your password within three weeks for better security.

Navigating the Member Portal

After signing up, members get access to the DCU Member Portal. It’s a key tool for managing accounts. This platform makes banking tasks simpler, all in one place.

Accessing Your Accounts

The portal lets users check balances and see transaction histories easily. Its user-friendly design keeps you informed about your finances. You can switch between accounts smoothly, making sure you have all the details you need.

Utilizing Online Banking Features

DCU’s online banking features make banking better. You can move money, pay bills, and use mobile deposit without hassle. Services like loan payments and budget tracking help with financial management. The platform is built to meet different needs, making every transaction easy and efficient.

Understanding Different Account Types

Digital Federal Credit Union offers many account types to fit different financial needs. Knowing about these options helps people choose wisely, matching their goals.

Checking and Savings Account Options

Checking and savings accounts are key for managing money. Digital Federal Credit Union has checking accounts with no minimum to open and no monthly fees. They offer ATM fee reimbursements and interest on some balances.

For savings, DCU’s Primary Savings has a high Annual Percentage Yield (APY) of 6.17% on balances up to $1,000. This can really boost your savings.

Special Accounts for Members

Digital Federal Credit Union also has special accounts for certain needs. For example, the Advantage Savings Account has an APY of 3.56%. The SMART Savings Account offers an APY of 1.51% with insurance up to $3 million.

Members can also get Money Market Savings accounts starting at an APY of 1.71%. These accounts, along with savings plans and budgeting tools, help members reach their financial goals.

| Account Type | APY | Key Features |

|---|---|---|

| Primary Savings | 6.17% | High yield, federally insured |

| Advantage Savings | 3.56% | Enhanced growth |

| SMART Savings | 1.51% | Insured up to $3 million |

| Money Market Savings | 1.71% | More earnings for more savings |

| Checking Accounts | 0.00% | No fees, ATM reimbursements |

Promotions and Offers for New Members

Digital Federal Credit Union welcomes new members with exciting promotions. These offers aim to make your banking experience better. They provide great financial benefits.

Understanding Free Checking Benefits

Digital Federal Credit Union offers free checking benefits. New members can get a DCU Free Checking Account without monthly fees. There’s a $20 sign-up bonus for those who use a referral link and meet certain criteria.

To get this bonus, you can either set up a direct deposit of at least $500 a month. Or, you can make five qualifying transactions in the first month after opening your account.

- No monthly fees for checking accounts.

- $20 cash bonus deposited within 30 days after meeting the requirements.

- Referring members also enjoy rewards for each successful sign-up.

Special Interest Rates and Promotions

New members can also find great interest rates on savings accounts. For example, opening a DCU Primary Savings Account can earn you 6.17% APY on balances up to $1,000. You just need to keep a minimum balance of $5 to stay a member.

| Balance Amount | APY |

|---|---|

| Up to $1,000 | 6.17% |

| Over $1,000 | 0.25% |

The promotions are meant to attract a wide range of members. There’s no limit on referrals, and the offers don’t have an expiration date. This means members can keep enjoying benefits as they invite others to join.

Conclusion

The digital federal credit union sign up is easy and rewarding for new members. It offers many benefits, like a detailed financial services overview. This helps people improve their financial health.

Features like no monthly fees for checking accounts and low loan rates show DCU cares about its members. This makes joining a great choice.

Prospective members can easily sign up by knowing the requirements and gathering needed documents. People have shared positive experiences, like quick approvals and easy online account management. This shows the value of joining a credit union that values education and personal service.

Starting your financial journey is easy with the digital federal credit union sign up. It offers great ATM access, special deals, and lower interest rates than banks. Joining DCU is a smart move for anyone wanting to improve their finances.