Whether you’re moving to the Sunshine State, visiting for a vacation, or are a long-time resident, knowing where you can access your Digital Federal Credit Union (DCU) account is essential. You might be looking for a local branch to make a deposit or a nearby ATM to grab some cash.

This guide will clarify DCU’s physical presence in Florida and show you how to access your money at thousands of locations across the state.

Are There Official DCU Branches in Florida?

No. As of 2025, Digital Federal Credit Union does not operate its own official, DCU-branded branches in the state of Florida. DCU’s physical branches are concentrated primarily in Massachusetts and New Hampshire.

But that doesn’t mean you can’t do your banking in person. Thanks to a nationwide partnership, you have access to a massive network of partner credit unions.

The Good News: How to Bank at Thousands of Locations via the CO-OP Network

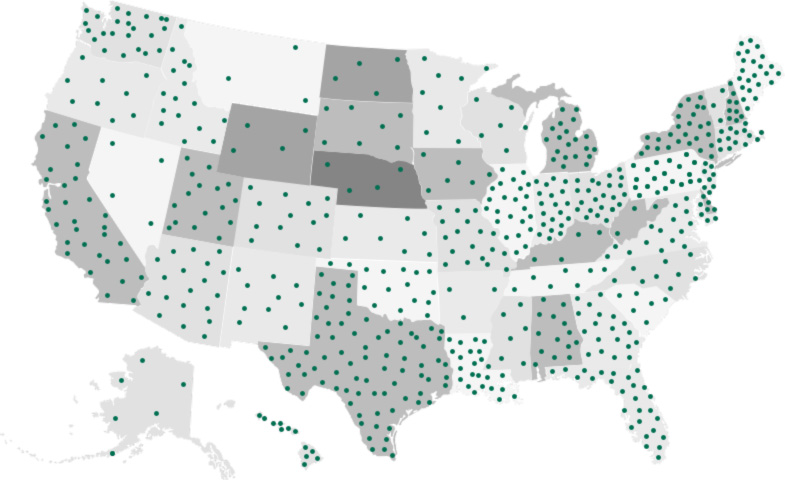

DCU is part of the CO-OP Shared Branch Network. This is a cooperative effort between thousands of credit unions across the United States to share their facilities. For you, this means you can walk into any participating credit union branch in Florida and perform transactions on your DCU account as if you were at your home branch.

Think of it as having a key to thousands of credit union lobbies across the country, all for free.

Finding a “Shared Branch” Location in Florida

It’s easy to find a participating credit union near you.

Using the CO-OP Shared Branch Locator Tool

The official locator tool is the most up-to-date resource. You can search by city, state, or zip code to see a map of all available locations.

- Official Locator Link: CO-OP Shared Branch & ATM Locator

What to Look For: The CO-OP Logo

When you visit a partner credit union, look for the CO-OP Shared Branch logo on the door or window. It’s a red and black swirl that signals you’re in the right place.

What Services Are Available at a Shared Branch?

You can perform most of your routine transactions at a shared branch. Here is a checklist of common services:

- ✅ Deposits (Cash and Checks)

- ✅ Withdrawals (Limits may vary by location)

- ✅ Loan Payments

- ✅ Transfers Between Accounts

- ✅ Account Balance Inquiries

Finding Surcharge-Free ATMs Across Florida

If you just need to get cash, the ATM network is even larger than the shared branch network. DCU participates in several surcharge-free ATM networks, including Allpoint, SUM, and CO-OP. The locator tool linked above will show you all nearby surcharge-free ATMs.

What You Need to Bring to a Shared Branch Location

This is the most important step! To access your DCU account at a partner credit union, you must have the following:

- ✅ Your DCU Account Number. Simply having your debit card is not enough for teller service.

- ✅ A Valid, Government-Issued Photo ID. This includes a Driver’s License, State ID, or Passport.

The teller at the shared branch needs this information to securely locate and access your DCU account.

Important: What You Can’t Do at a Shared Branch

While shared branches are convenient for routine transactions, they cannot help with DCU-specific account management. Services you cannot get at a shared branch include:

- ❌ Applying for a DCU loan or mortgage

- ❌ Opening a new DCU account or certificate

- ❌ Getting a DCU-specific cashier’s check

- ❌ Resolving complex issues like fraud claims or account disputes

When You Can’t Get to a Branch: Using DCU’s Digital Tools in Florida

For services that require DCU directly, you can use their excellent digital tools from anywhere in Florida:

- Mobile Check Deposit: Use the DCU Mobile App to deposit checks with your phone’s camera.

- Online Banking: Transfer funds, pay bills, and manage your accounts from the DCU website.

- Customer Service: Call DCU’s Information Center at

1-800-328-8797for account support.

Conclusion: You’re Covered in the Sunshine State

Key Takeaway: While you won’t find a building with a “DCU” sign in Florida, you are far from stranded. Through the CO-OP Shared Branch network, you have thousands of partner credit union branches and surcharge-free ATMs ready to serve you across the entire state. Just remember to bring your account number and a valid photo ID.

Frequently Asked Questions (FAQ)

Is there a fee to use a CO-OP Shared Branch? No. Using the shared branch network is a completely free service for DCU members.

How much cash can I withdraw at a shared branch? Withdrawal limits are determined by the host credit union’s policies. While often generous, the limit may differ from what you are used to at a home DCU branch. It’s best to ask the teller about their specific limit if you need a large amount.

Can I get a cashier’s check at a shared branch? You can typically get a cashier’s check issued by the host credit union, but not one issued by DCU. If you specifically need a check drawn on your DCU account, you will need to contact DCU directly.

Does DCU plan to open branches in Florida? As a “digital first” credit union, DCU focuses on providing robust online and mobile services supplemented by the shared branch network rather than opening a large number of its own physical branches nationwide. Always check the official DCU website for any future announcements.